Understanding Historical Volatility

Understanding Historical Volatility

Importance of Grasping Historical Volatility

Why Grasping Historical Volatility is Crucial

If you’re a budding financial engineer, investor, or market enthusiast, understanding historical volatility is crucial. Historical volatility, by referencing past price data, offers insights into the market’s perception of risk. Not only does it aid in evaluating the riskiness of an asset, but it also assists in crafting strategies to manage portfolios effectively.

Relevance in Finance and Investing

- Finance and Investing: Historical volatility reflects the risk tied to an asset. A high volatility implies higher risk, which often translates to higher returns.

- Portfolio Management: Volatility helps in diversification by understanding how volatile an asset is compared to others in the portfolio.

- Derivatives Pricing: It is indispensable in options pricing. Models like Black-Scholes employ historical volatility to estimate an asset’s future risk.

Why We Need This Concept

- Risk Assessment: Enables us to quantify the risk and potential variation in returns for any given asset.

- Investment Decisions: Guides investors on whether the asset’s risk matches their risk appetite.

- Benchmarking Performance: Facilitates comparisons with historical norms to identify unusual market behavior.

Defining of Historical Volatility

Breaking Down the Key Formula

Historical volatility measures how much the price of a stock varies over a period. The fundamental formula for historical volatility is:

Where: -

Annualizing Weekly Volatility

To annualize the volatility calculated from weekly data, we use:

This conversion is necessary as it scales the weekly volatility to an annual level, making comparisons with annualized returns straightforward.

How Parameters Affect the Results

- Number of Observations (

- Logarithmic Returns (

- Average Logarithmic Return (

Section 3: Building Charts Using Python

In this section, we’ll use pandas, matplotlib, and yfinance to fetch historical data of SPY and calculate its historical volatility.

Fetching Historical Data

First, let’s fetch the historical weekly closing prices for SPY using the yfinance library.

Calculating Weekly Log Returns

We’ll compute the weekly log returns from the closing prices.

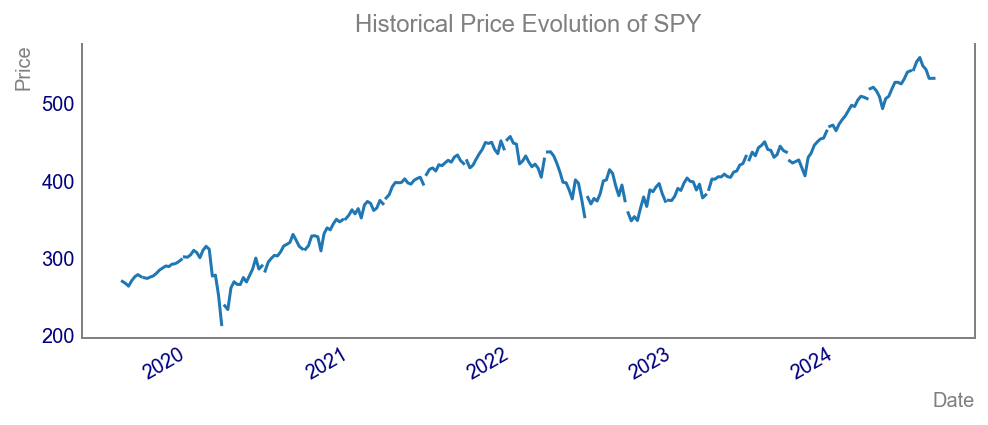

Plotting the Historical Price Evolution

We’ll now create a line chart displaying the historical price evolution of SPY over the past 5 years.

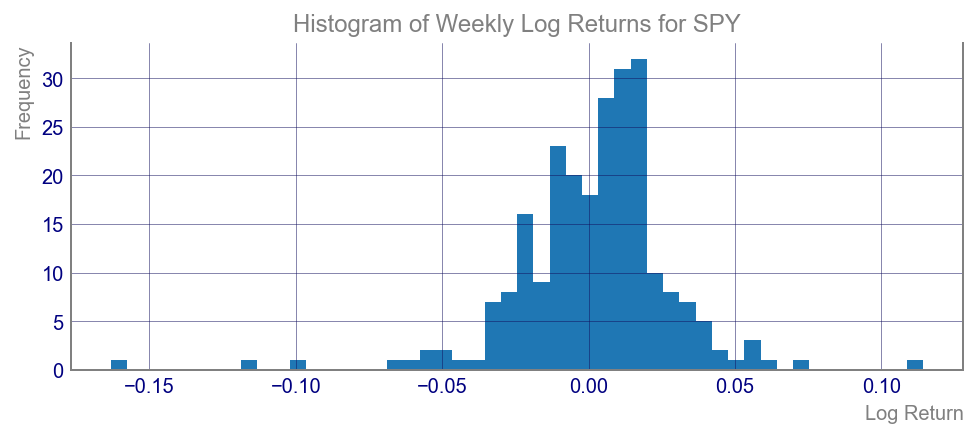

Histogram of Weekly Return Distributions

Next, let’s create a histogram of the weekly return distributions for SPY over the past 5 years.

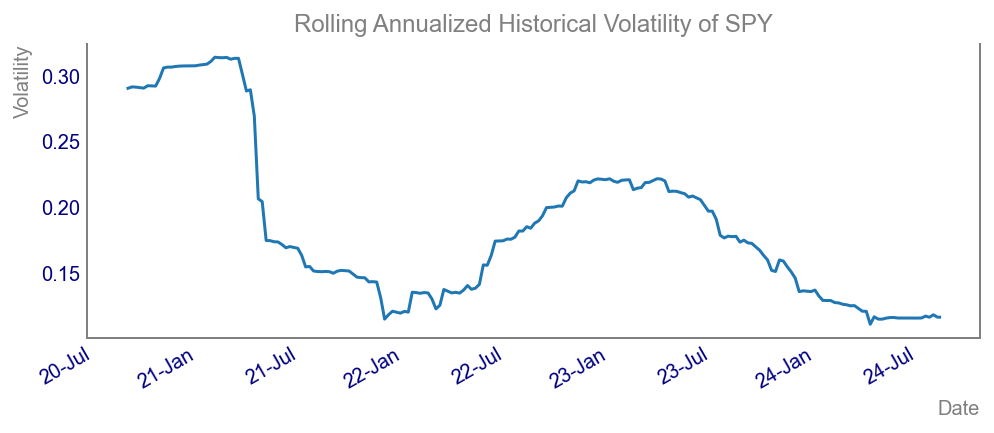

Rolling Annualized Historical Volatility

We’ll now calculate the rolling annualized historical volatility using a 52-week rolling window and plot it.

Code

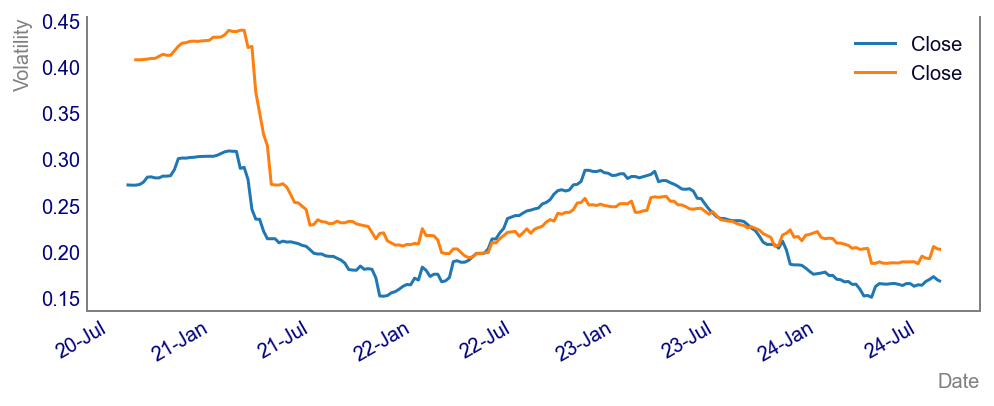

Comparing 2 assets by their volatility

Let’s create a scatter plot comparing the annualized historical volatility as derived from weekly SPY returns against the performance of other ETFs.

Code

# Fetching historical data for other ETFs

qqq = yf.Ticker("QQQ").history(period="5y", interval="1wk")["Close"]

iwm = yf.Ticker("IWM").history(period="5y", interval="1wk")["Close"]

# Calculating log returns for other ETFs

log_returns_qqq = np.log(qqq / qqq.shift(1)).dropna()

log_returns_iwm = np.log(iwm / iwm.shift(1)).dropna()

# Calculating annualized volatility for other ETFs

vol_qqq = log_returns_qqq.rolling(window=52).std() * np.sqrt(52)

vol_iwm = log_returns_iwm.rolling(window=52).std() * np.sqrt(52)

# Creating the scatter plot

fig, ax = plt.subplots()

vol_qqq.plot(ax=ax)

vol_iwm.plot(ax=ax)

plt.ylabel('Volatility')

plt.legend()

plt.show()

Conclusion

Practical Applications

Understanding historical volatility allows you to assess the risk and behaviour of assets over time. It is invaluable in portfolio management and derivative pricing.

Limitations

- Past vs. Future: Historical volatility relies on past data and isn’t always indicative of future movements.

- Distribution Assumptions: It assumes a normal distribution, which may not always be true in real-world markets.

Final Thoughts

By integrating historical volatility into your analysis, you can better navigate the financial markets. Don’t forget, you can always refer to the corresponding video on the Data Driven Minutes Youtube channel for a more visual walkthrough.