Code

import yfinance as yf

import matplotlib.pyplot as plt

import pandas as pd

# Fetch data

qqq = yf.Ticker('QQQ')

spy = yf.Ticker('SPY')

qqq_hist = qqq.history(period='max', interval='1wk')

spy_hist = spy.history(period='max', interval='1wk')

spy_hist = spy_hist.reindex(qqq_hist.index)

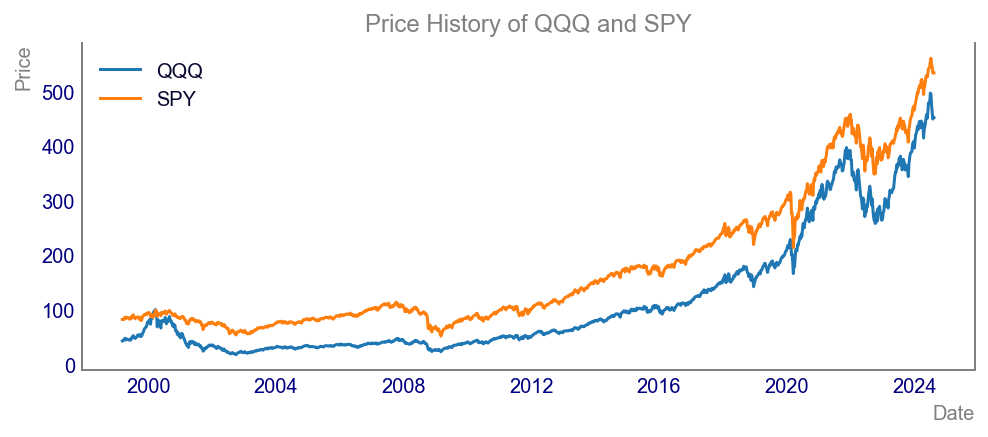

# Plotting price history

plt.style.use('getting_started-chart.mplstyle')

fig, ax = plt.subplots()

ax.plot(qqq_hist.index, qqq_hist['Close'], label='QQQ')

ax.plot(spy_hist.index, spy_hist['Close'], label='SPY')

ax.set_title("Price History of QQQ and SPY")

ax.set_xlabel("Date")

ax.set_ylabel("Price")

ax.legend()

plt.show()